When it comes to real estate investment, the debate between vacation rental investing and traditional long-term rentals hotter than ever. Both models promise attractive returns, but each comes with distinct strategies, risks, and rewards. If you’re planning your capital allocation, it’s crucial to understand which option offers the superior ROI for your specific goals. Let’s dive into a comprehensive comparison to help you confidently choose your next property investment.

The vacation rental market passed $94B in 2024 and is growing at 3.57% CAGR — vacation rental investing is no longer niche. It’s where serious operators are building wealth. Want a full 2026 strategy to scale your Airbnb investment portfolio?Read our complete Airbnb Investment Blueprint →

Vacation Rental Investing: High Returns, High Maintenance

Vacation rentals—especially through platforms like Airbnb—have revolutionized property investing by delivering outsized returns in the right markets. But before you get excited by the high revenue potential, it’s important to understand how short-term rental investing really works. Let’s break down the pros and cons, and walk through what they look like in real life.

Pros of Vacation Rental Investing

Higher Revenue Potential: Short-term rentals generate 2–3× more monthly income than traditional leases on average. According to AirDNA’s 2025 U.S. STR Outlook, the U.S. STR market averaged 54.9% occupancy in 2025 with RevPAR up 12% year-over-year.

Dynamic Pricing Advantage: Tools like Wheelhouse and PriceLabs can boost revenue by 15–40% through AI-driven rate adjustments.

Personal Use Flexibility: Unlike long-term rentals, you can use your property during off-peak seasons or hold it for personal use without disrupting lease agreements.

Take a beachfront property in Tulum, for example. During peak season, the nightly rate may jump from $250 to $600, and operators using dynamic pricing can fill the calendar faster while maximizing earnings. One WaveBNB client leveraged these tools to go from $4,000/month to over $12,000/month in revenue within their first 90 days.

Cons of Vacation Rental Investing

Market Volatility: Seasonality and competition drive occupancy swings—STR occupancy can vary from 30% in off-season to 80% at peak.

- Operational Complexity: You’ll manage frequent turnovers, guest communications, plus marketing and housekeeping—think of it like running a hotel.

With AI agents and automated pricing, you can scale to 10+ properties without hiring a team. (See how it works in our [AI Airbnb Growth Stack] lead magnet or dive deeper in our Airbnb Investment Blueprint.)

Increased Expenses: Cleaning, utilities, supply replenishment, and platform fees (15–20% host fee + up to 14% guest fee on Airbnb) add up quickly.

But here’s the good news: smart operators turn these challenges into profit engines. WaveBNB clients routinely achieve a 30–50% revenue lift within 90 days by leveraging AI-driven dynamic pricing, automated messaging, and direct-booking funnels—cutting OTA fees to as low as 3%.

👉 Book a free strategy call with WaveBNB

Long-Term Rentals: Stability and Predictability

Long-term rentals have long been the foundation for passive income investors. These properties generally require less active management and deliver consistent, reliable income—but can also limit growth.

Pros of Long-Term Rentals

Stable Income: Consistent rent payments mean reliable cash flow, with typical cap rates of 5–10% in many U.S. markets (Zillow Forecast for 2025).

Lower Effort: Tenants handle day-to-day upkeep; turnover costs drop significantly.

Simpler Compliance: Zoning and licensing hurdles are generally less stringent than for STRs.

For example, a 2-bedroom apartment in Austin leased for $2,500/month brings $30,000/year with minimal upkeep. A single long-term tenant might stay 2–3 years, cutting vacancy losses and management overhead.

Cons of Long-Term Rentals

Limited Revenue Ceiling: Rent usually caps out unless you renovate or enter a high-growth market.

Vacancy Risk: Extended marketing periods can leave units empty for weeks or months.

Inflexibility: It’s harder to seize short-term demand peaks, like major events or seasonal booms.

That same Austin apartment may earn $2,500 consistently, but during high-demand events like SXSW, vacation rentals in the area earn $500+/night—leaving long-term landlords missing big opportunities.

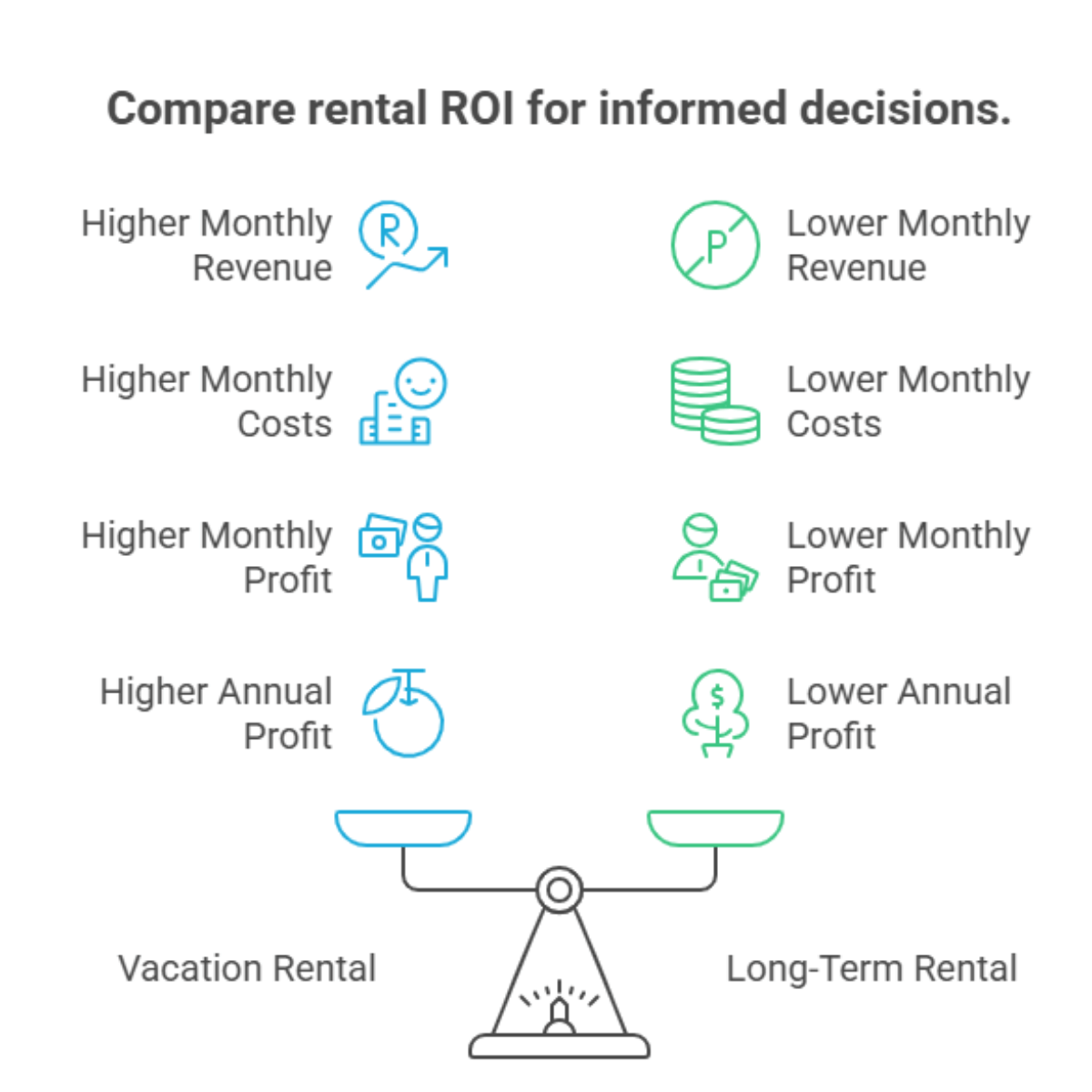

Comparing ROI: Crunching the Numbers

| Model | Monthly Revenue | Monthly Expenses | Monthly Profit | Annual Profit |

|---|---|---|---|---|

| Vacation Rental | $6,000 | $3,000 (mortgage, utilities, platform fees) | $3,000 | $36,000 |

| Long-Term Rental | $2,500 | $1,500 (mortgage, taxes, maintenance) | $1,000 | $12,000 |

Even after accounting for higher operational costs, vacation rentals deliver tripled profits in this scenario—but demand hands-on management or professional automation.

Want to test your own numbers? Run them through our Vacation Rental ROI Calculator

Real-World Case Study: How Smart Operators Win

One WaveBNB client in Arizona converted a long-term unit into an STR:

Before: $30,000 annual revenue (long-term)

After: $90,000 annual revenue (short-term)

Strategy: Leveraged AI-driven dynamic pricing and fully automated guest journeys → 3× revenue lift with minimal added work.

👉 See how WaveBNB’s AI Agents automate bookings 24/7

Mitigating Risk: Diversification & Hybrid Approaches

Can’t decide between the two? You don’t have to. Many successful investors run hybrid models:

Peak Season: Maximize nightly rates on STR platforms.

Off-Peak: Offer mid-term (1–3 months) leases or monthly stays.

This strategy smooths income and protects occupancy. According to STR Insights, hybrid properties average 74% occupancy—compared to 57% for traditional STRs. One WaveBNB client in Miami uses this approach and now enjoys year-round cash flow with flexible pricing.

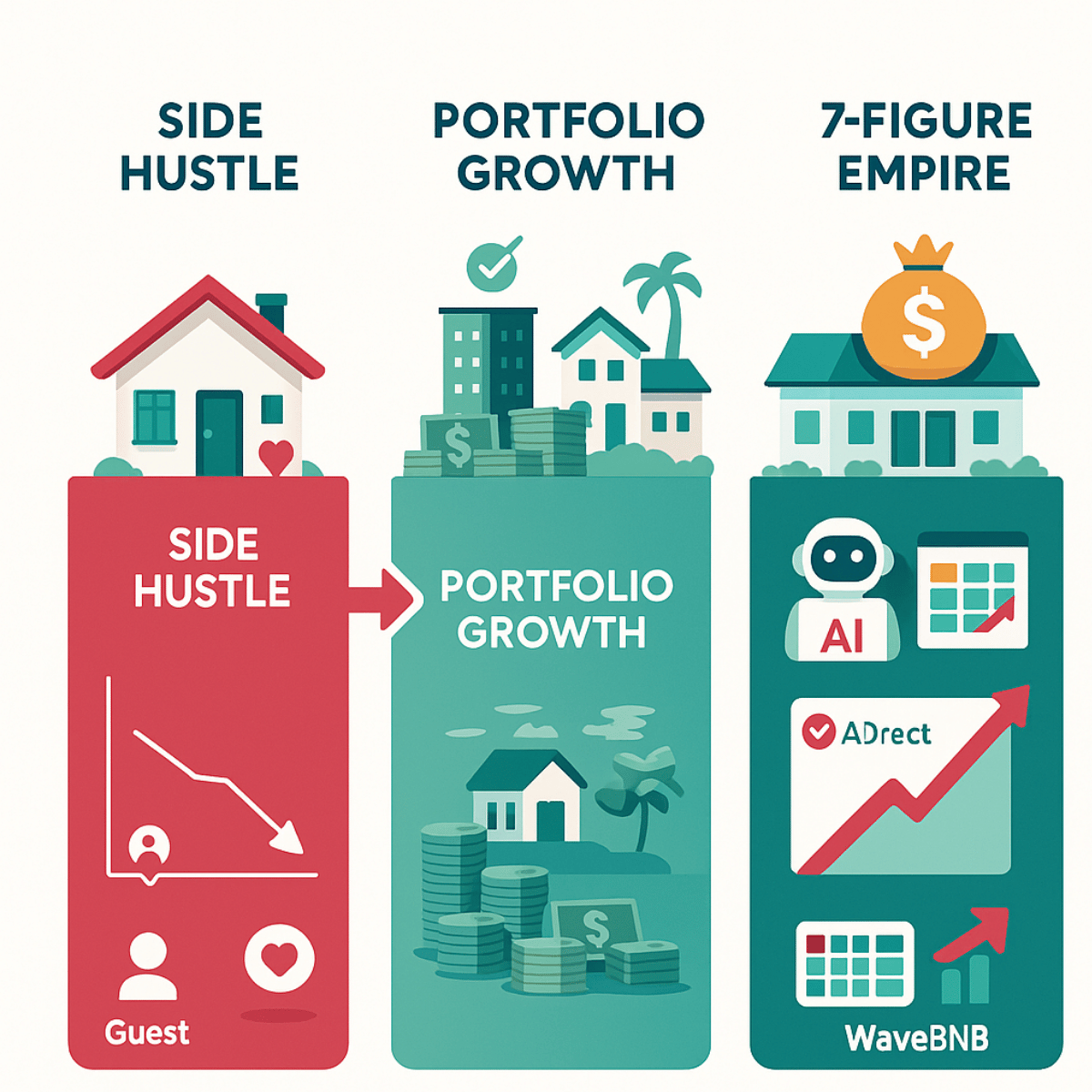

The Future of Vacation Rental Investing: AI & Automation

This is where things get really interesting. AI and automation now handle up to 80% of guest interactions. WaveBNB’s AI Concierge and Sales Agents:

Boost occupancy by instantly replying to every inquiry

Increase conversion by up to 40% via personalized booking flows

Drive reviews with proactive follow-up and support

In practice, this means you can scale from 1 to 10 properties without needing a full-time team—it’s a leveraged growth strategy.

Which Offers the Better ROI?

Choose Vacation Rentals if you want maximum returns, embrace market fluctuations, and can deploy or outsource automation.

Choose Long-Term Rentals if you value stability, hands-off management, and predictable cash flow.

Consider a Hybrid Strategy to blend high-profit peaks with reliable base income.

The data is clear: short-term rentals, when powered by AI and expert operations, offer superior ROI potential.

👉 Ready to unlock your property’s full earning power? Book your free growth strategy call with WaveBNB today →