Ready to turn your Airbnb investment from a simple side hustle into a 7-figure machine that pays you year after year?

This is your blueprint for 2026 — a year primed for strategic expansion and record returns. Why? Because the current market dynamics are creating a perfect storm of opportunities:

Rising travel demand + higher average daily rates (ADR).

OTA fees eating deeper into margins, pushing guests to book direct.

A flood of new tech — from AI pricing to loyalty CRMs — that lets even solo hosts run like professional operators.

This guide breaks it all down, drawing on WaveBNB’s proven growth frameworks used by top Airbnb entrepreneurs. Inside, you’ll discover:

✅ How to lock in peak pricing and protect your margins with dynamic, data-driven rate strategies.

✅ Build automated guest experiences that drive 5-star reviews & repeat stays without adding headcount.

✅ Structure your operations like a real investment portfolio, so your properties appreciate faster while cash flowing stronger.

✅ Slash OTA fees and build a direct booking ecosystem that maximizes lifetime guest value.

Whether you’re managing 2 listings or 25, this is how you grow smarter — not just bigger. The endgame?

Consistent monthly cash flow, rising property values, and a future-proof STR brand that outpaces the market year after year.

Quick Jump Index

1️⃣ Why 2026 Is the Best Time to Invest in & Scale an Airbnb Business

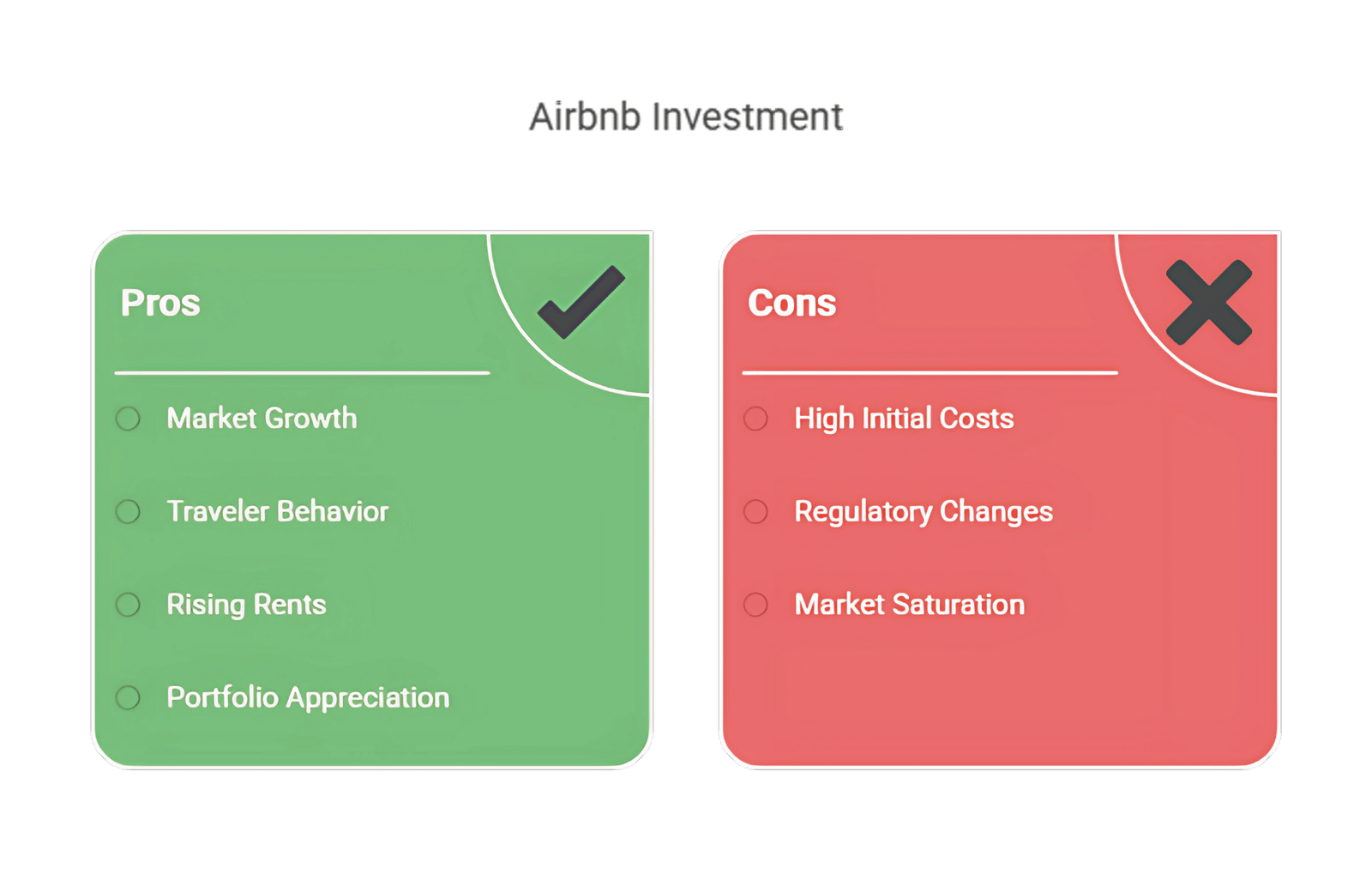

Global travel demand isn’t just rebounding — it’s breaking past pre-pandemic highs and setting the stage for a record decade ahead, creating the perfect climate for any serious Airbnb investment.

The short-term rental (STR) sector is projected to reach $8.91 billion by 2026, a massive leap driven by lifestyle shifts toward flexible, experiential travel — a trend that directly boosts Airbnb investment opportunities.

Meanwhile, the broader vacation rental market already soared past $94.45 billion in 2024, and is on track to exceed $134.26 billion by 2034, compounding at 3.57% CAGR — making this one of the best decades ever to grow your Airbnb investment portfolio.

🚀 Why this matters for you right now

Early operators secure the best returns.

Rising demand meets tightening supply — a combination that pushes average daily rates (ADRs) higher. By scaling your Airbnb investment now, you lock in properties before the next pricing surge, capitalizing on both cash flow and long-term appreciation.Guest behavior is shifting in your favor.

36% of travelers prioritize price, hunting for better deals than hotels or inflated OTA markups. A staggering 70.9% cite reviews as their #1 decision driver — meaning hosts who optimize guest experiences, automate quality control, and stack up 5-star ratings win disproportionately, protecting their Airbnb investment returns.Forecasts show rents continuing to rise through 2026, shrinking vacancy windows and further propping up nightly rates. The market dynamics are set for operators who move fast to capture premium returns on their Airbnb investments.

💡 The strategic play for your Airbnb investment

The operators scaling their Airbnb investment portfolios now — while direct bookings, predictive pricing, and AI guest tools are still underutilized by average hosts — will be the ones sitting on durable, high-cash-flow assets by 2028–2030, while late entrants pay peak asset prices.

So whether you’re eyeing your first multi-unit Airbnb investment or ready to double your portfolio, 2026 is the sweet spot:

A perfect window to ride the revenue boom, lock in appreciating assets, and build an Airbnb investment brand that outpaces the entire market.

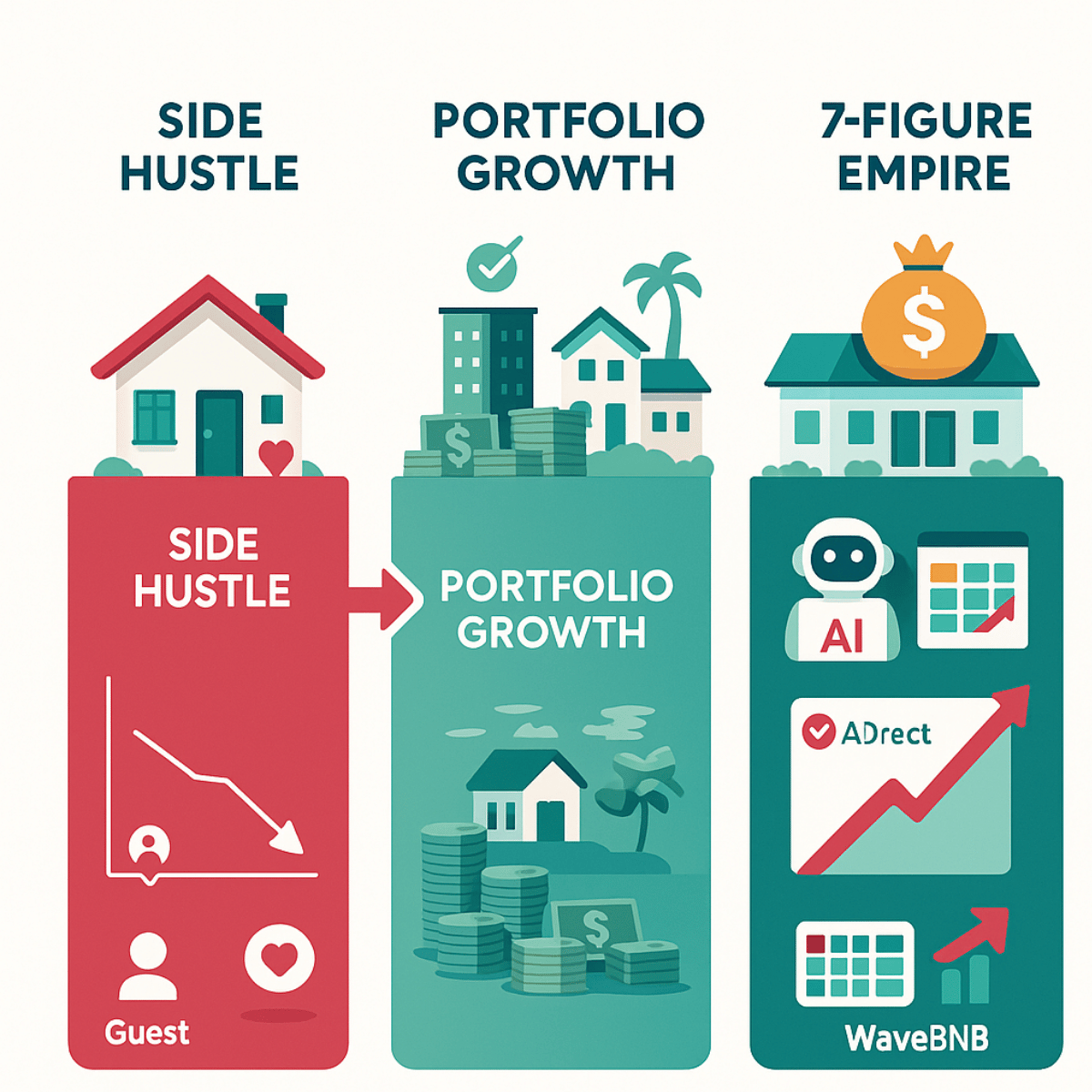

2️⃣ Short-Term Rental Growth: From Side Hustle to a 7-Figure Airbnb Investment

Most hosts start the same way:

One property. Some welcome side income. But that’s also where most get stuck — managing a small, fragile operation that lives or dies by Airbnb’s algorithm, racing to fill calendar gaps month to month. Their Airbnb investment never grows beyond a side project.

🚀 The shift? Build leveraged Airbnb investments, not just rentals.

The real breakout comes from treating each property like an appreciating Airbnb investment asset that throws off growing cash flow year after year — transforming your side hustle into a 7-figure wealth engine.

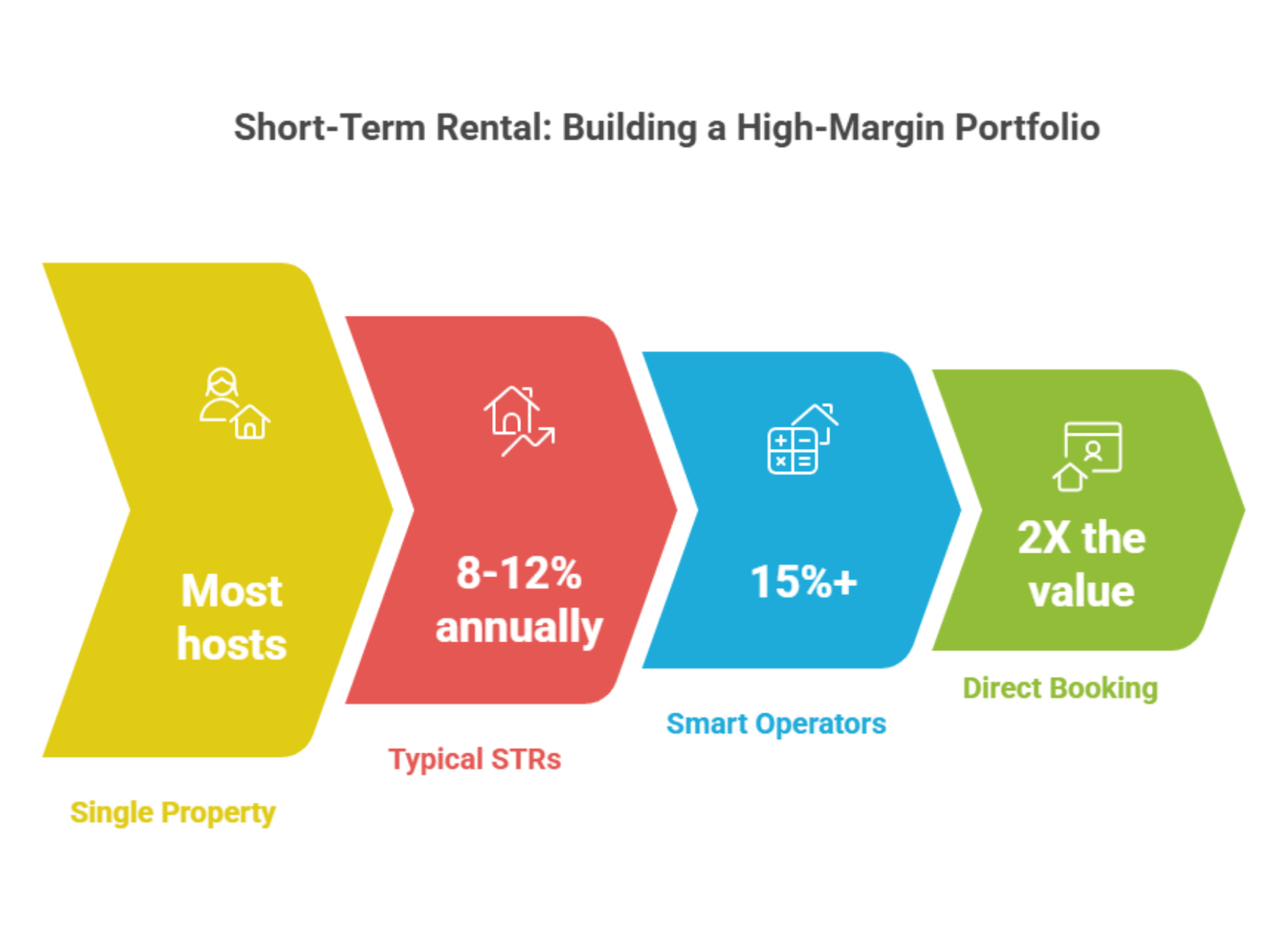

💸 Aim for ROI that destroys the market average

Typical STRs generate 8–12% annual returns.

Smart operators routinely target 15–20%+, by:

Using dynamic pricing to capture peak ADRs and fill low-season dips.

Running lean, systematized operations that drive down costs.

Plowing cash back into new listings or smart upgrades that let them raise rates.

Compound that over multiple properties, and you’re not just building income — you’re stacking wealth that outpaces most other real estate classes.

🛠 Run like a professional, not a DIY landlord

Coordinating maintenance, cleaning, guest experience, and local compliance manually? That caps your scale (and keeps your returns average).

Operators who deploy automated scheduling, SLAs for cleaners, and AI guest messaging see 30–50% higher net returns — because their machine doesn’t leak money on missed turns, poor reviews, or last-minute scramble costs.

🚀 Own your brand, not just an Airbnb listing

Airbnb is a marketing platform, not your business.

Direct bookings cut OTA fees by up to 80%, but the bigger play is lifetime value:

Repeat guests book again, bring friends, and cost $0 to acquire — making them often 2–3x more profitable than new OTA customers.

A standardized guest experience, loyalty incentives, and consistent brand visuals make guests remember your property name — not just Airbnb.

✅ The bigger picture: Build a resilient, high-margin Airbnb investment portfolio

Scaling smart isn’t just about stacking more listings.

It’s about transforming scattered homes into a systematized Airbnb investment portfolio that:

Leverages tech (AI pricing, smart CRM, IoT) to run lean and protect your Airbnb investment margins.

Diversifies into multiple markets to hedge seasonality or local rule changes, keeping your Airbnb investment returns steady.

Locks in a premium brand reputation that lets you charge top-of-market rates, maximizing the lifetime value of your Airbnb investments.

That’s how you move from reactive hosting — hoping next month fills — to building a true 7-figure Airbnb investment business that grows equity and spins off consistent cash flow, regardless of the market cycle.

3️⃣ Core Strategies to Scale Your Airbnb Investment in 2026

If your goal is to transform your Airbnb hustle into a scalable, high-margin Airbnb investment that systematically builds equity and spins off growing cash flow, here’s exactly how top operators are doing it right now.

🌎 Diversify Beyond One Market or Asset Type

The smartest investors don’t just keep buying more of the same. They strategically diversify their Airbnb investments, balancing:

-

City apartments that drive steady, year-round business travelers.

-

Luxury rural retreats or villas that book high ADR weekends and holiday peaks.

This does three things simultaneously for your Airbnb investment portfolio:

-

Smooths out seasonal dips, so one quiet winter doesn’t crash your cash flow.

-

Captures multiple guest segments, from honeymooners to corporate retreats.

-

Spreads regulatory risk, so a crackdown in one city doesn’t jeopardize your entire Airbnb investment strategy.

💰 Use AI-Driven Dynamic Pricing to Maximize ADR & Occupancy

Static pricing is dead. With modern AI pricing tools, your nightly rates adjust multiple times daily based on:

-

Real-time local demand

-

Upcoming events

-

Competitor rates and booking velocity

The result? You capture high peaks without leaving money on the table, and stay attractive in slower stretches.

Real-world impact:

-

One WaveBNB client in Aspen jumped from 40% to 90% occupancy, adding +$125K in annual revenue, simply by replacing manual pricing with a smart engine.

This isn’t a one-time bump — it compounds every month.

🤖 Automate Guest Comms & Reviews with AI Agents

Manual messaging is the #1 scale killer for operators.

Handling every check-in, mid-stay question, and post-stay review chase by hand might work for 1–2 units — but at 5 or 20, it caps your growth.

-

AI guest agents handle 80%+ of routine conversations instantly, from arrival logistics to local recs.

-

They proactively ask for reviews post-stay, boosting your volume by 50–60%, which lifts rankings and conversions.

-

And with smart upsell flows, they drive add-ons like early check-in or private tours, padding your top line without adding staff.

🎯 Run Retargeting Campaigns to Capture “Almost-Bookers”

Most hosts pay to get eyeballs once — then watch visitors bounce forever.

The best operators run smart retargeting campaigns on Google, Facebook, and Instagram that:

-

Track visitors who checked dates but didn’t book.

-

Serve them dynamic ads highlighting special offers or low availability urgency.

-

Pull them back to close, converting 2–5X better than new cold traffic.

🏆 Anchor It All in Real, ROI-Driven Airbnb Investment Playbooks

This isn’t just theory — it’s tested at scale on real Airbnb investments.

-

One WaveBNB client tripled bookings in 90 days, purely by tightening listings, stacking local SEO, and layering on retargeting + direct booking incentives that safeguarded their Airbnb investment returns.

-

Another grew direct inquiries by +150%, reducing OTA fees dramatically and building a repeat guest flywheel — strengthening their overall Airbnb investment portfolio.

When you combine these strategies — diversifying assets, locking in dynamic pricing, automating guest experience, and actively chasing lost visitors — you turn scattered listings into a predictable, resilient Airbnb investment machine.

4️⃣ Portfolio Management for Your Airbnb Investment & Short-Term Rentals

Turning a handful of listings into a real Airbnb investment business isn’t about just stacking more doors.

It’s about managing your portfolio like an investor — maximizing returns, protecting downside, and building equity that compounds to safeguard your Airbnb investment strategy.

That’s the difference between a side hustle that fizzles in slow seasons and a scalable, high-yield Airbnb investment enterprise that grows year over year.

🧭 See the Full Airbnb Investment Picture in One Place

The top operators aren’t fumbling through disconnected Airbnb, Vrbo, and Booking.com dashboards, guessing at performance property by property. They protect and grow their Airbnb investments by:

-

Tracking ADR, occupancy, RevPAR, channel mix, and marketing ROI across their entire Airbnb investment portfolio — whether that’s 5 listings or 50+ — in a unified dashboard.

-

Spotting underperformers instantly, doubling down on winners, and treating each home as a data-backed Airbnb investment asset, not a wildcard on the calendar.

📈 Forecast Like a Pro — Avoid Cash Flow Surprises

Amateurs get crushed by surprise low seasons.

Pros use predictive analytics to:

-

Anticipate dips, and adjust rates or promos before a slow month ever arrives.

-

Confidently price shoulder periods to maintain cash flow.

-

Plan capital upgrades — like adding a pool or designer furnishings — knowing precisely when it will pay back.

Real operators don’t guess if a $30K pool install will ROI.

Their portfolio models show how higher ADR + occupancy will cover it in 8 months — so it’s a clear green light.

💵 Optimize Capital, Scale Smarter

Most casual hosts either buy with traditional mortgages or worse, pay cash — tying up precious liquidity and slowing growth.

But real portfolio managers:

-

Blend equity, low-cost conventional loans, and specialized STR financing to keep their cost of capital lean.

-

Use smart leverage to deploy smaller down payments across multiple properties, multiplying returns instead of dead money in single deals.

The result?

-

Faster expansion into new markets without bleeding cash reserves.

-

More agile, higher ROI growth, because they’re always balancing risk and upside like a pro investor — not a hobbyist.

🏆 The bottom line

If you want a short-term rental empire that spits off predictable cash flow, appreciates like clockwork, and builds long-term wealth, you have to manage it like a portfolio:

✅ Unified visibility over every key metric

✅ Predictive forecasting that informs smart reinvestments

✅ Strategic capital structures that let you scale while protecting your downside

That’s how you go from hoping next month fills… to running a 7-figure portfolio that pays you (and your investors) every single month.

5️⃣ Advanced Tactics to Maximize Your Airbnb Investment ROI

If you’re already running a profitable short-term rental business, the next leap isn’t about just adding more listings.

It’s about extracting more value from every guest, every night, every dollar — turning solid portfolios into 7- and 8-figure cash machines.

Here’s how the smartest operators and STR investors make that happen:

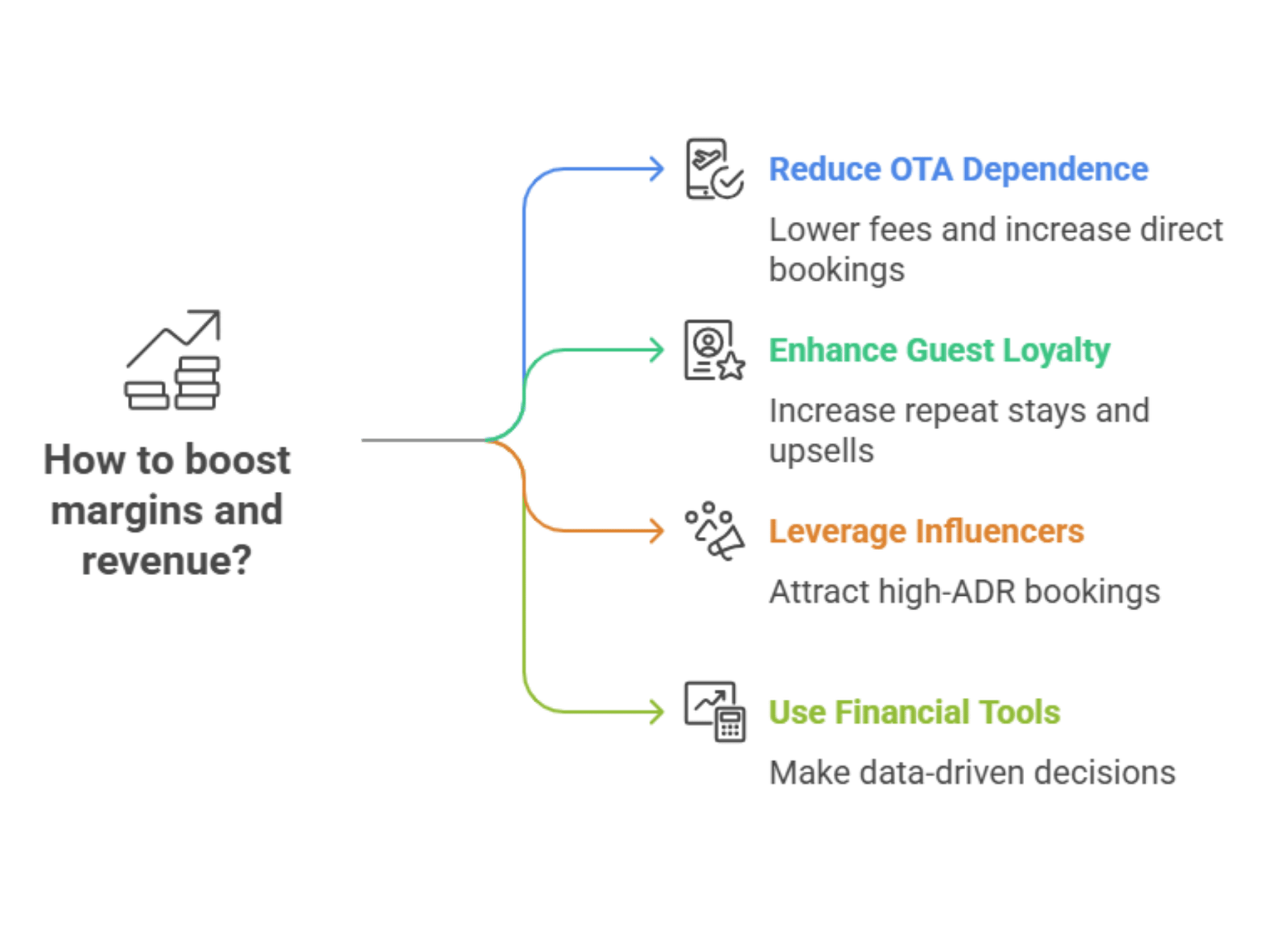

💰 Cut OTA Fees — Keep More of What You Earn

One of the fastest ways to drive your net margins higher? Break OTA dependency.

Most hosts think they’re only paying a 3% host fee, but in reality:

-

Guests pay 14–20% service fees, per the EasyInvest OTA Commission Report.

-

Combined, this drives all-in commissions to 15–25%+, especially as OTAs layer on costs for add-ons (a trend highlighted by PrenoHQ).

That means on $500,000 in gross bookings, you could bleed $75,000–$125,000 straight into OTA pockets.

✅ The solution:

-

Build a direct booking ecosystem — SEO-optimized site, fast mobile booking, secure payments.

-

Plug in loyalty perks, retargeting funnels, and automated reviews to maintain rankings + fill your calendar yourself.

Done right, this drops your effective commission burden to ~4.5%, keeping thousands more in your pocket each month and compounding your returns year over year.

🔄 Turn Guests Into Lifetime Revenue Streams

A one-time booking is nice. A guest who returns every year, books direct, and brings friends? That’s a lifetime profit center.

-

Launch loyalty perks: VIP discounts, priority booking windows, surprise upgrades.

-

Offer upsells that enrich the experience and your ADR — private chefs, spa packages, mid-stay cleaning, curated local excursions.

-

Build referral loops: guests who earn rewards for sending friends slash your acquisition costs to $0.

This doesn’t just boost RevPAR — it cuts marketing costs, because loyal guests don’t need to be re-acquired through paid channels.

📸 Use Influencers to Drive High-ADR Bookings

In luxury and premium markets, social proof is everything.

Strategic influencer partnerships position your property as the place to stay, sending high-spend travelers directly to your site.

-

Instagram reels, TikTok tours, and cross-promotions fill your calendar with guests willing to pay a premium for perceived exclusivity.

-

It’s not uncommon for influencer-driven bookings to outperform your average ADR by 20–50%, because demand is driven by lifestyle aspiration, not bargain hunting.

🧮 Think Like a CFO, Not Just a Host

The best operators don’t cross their fingers — they run the numbers.

By using WaveBNB’s suite of tools:

-

Revenue & Occupancy Calculator: Test how new pricing, better gap rules, or local events will lift your top line.

-

Break-Even Analyzer: Know exactly what your occupancy needs to be to stay cash-flow positive, even in shoulder seasons.

-

OTA Cost Calculator: See how shifting just 30% of bookings direct could add tens (or hundreds) of thousands to your annual bottom line.

This level of financial intelligence means you can confidently:

-

Plan capital upgrades (like adding a pool or designer furnishings).

-

Secure bank or investor financing with hard data.

-

Time new market entries based on proven ROI, not hopeful assumptions.

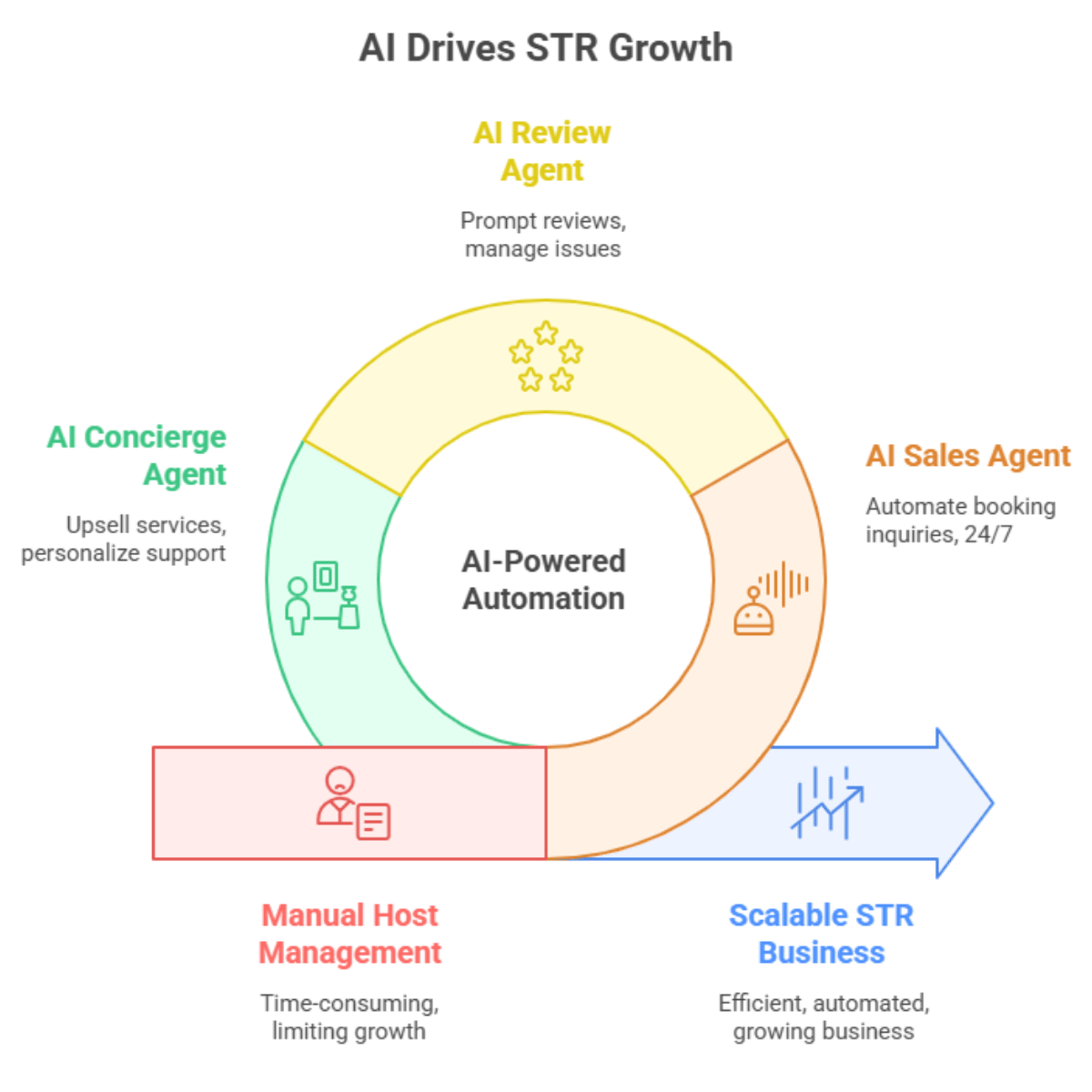

6️⃣ How AI & Automation Drive Airbnb Investment Growth

Most hosts get trapped in the grind, putting their Airbnb investment growth at risk:

Answering 11 PM booking questions, chasing down reviews, and manually juggling every guest request.

This doesn’t just cap your growth — it’s exactly what burns out even the most ambitious Airbnb investment owners.

🚀 This is where AI flips the entire model

With intelligent systems replacing hours of manual work, you transform your Airbnb, boutique hotel, or short-term rental portfolio into a truly scalable business — one that grows without demanding more of your nights, weekends, or headspace.

🤖 Picture your future business:

✅ AI Sales Agent:

-

Engages every inquiry the instant it lands — whether from your website, WhatsApp, Instagram DM, or direct OTA message.

-

Qualifies leads, answers availability & booking questions, and closes reservations on autopilot, 24/7.

-

No more losing bookings to faster competitors because you couldn’t reply in time.

✅ AI Review Agent:

-

Follows up with guests after checkout, prompting glowing 5-star reviews and smoothing out issues privately.

-

This means higher Airbnb & Google ratings, stronger SEO visibility, and more organic bookings that cost you nothing to acquire.

✅ AI Concierge Agent:

-

Gives guests VIP-level support by instantly answering local questions, restaurant recs, or activity ideas — all tailored to their stay.

-

Even better? It proactively upsells early check-ins, spa packages, private tours, or mid-stay cleaning.

-

This drives higher revenue per stay without a single extra staff hour.

📊 The numbers prove it

Hosts and operators using these AI-driven systems consistently see:

-

Up to 40% fewer manual tasks, freeing them to focus on expansion, new markets, or — finally — taking an actual vacation.

-

A 30% lift in repeat bookings, because happier guests come back direct, driving down your marketing costs and crushing OTA fees.

✅ The bottom line?

AI doesn’t just replace manual tasks — it compounds your margins, protects your guest reputation, and scales your business beyond what’s possible if you’re stuck answering every message by hand.

7️⃣ Top 5 Mistakes That Stall Airbnb Growth (And How to Avoid Them)

Most hosts hit an invisible ceiling — not because they lack beautiful properties, but because they repeat the same costly missteps that quietly choke scale and profitability.

If you’re serious about evolving from side hustle to a 7-figure STR business, here’s what the smartest operators ruthlessly avoid:

🚩 1. Relying 100% on Airbnb (or any single OTA)

Airbnb gives you instant visibility. But at a steep cost:

-

~18% average commission drag, once you account for both host fees and guest service fees that suppress total spend.

-

Zero ownership of guest data, no loyalty pipeline, and no way to insulate yourself if their algorithm suddenly changes.

The minute Airbnb tweaks visibility rules — or worse, your listing gets flagged or delisted — your entire revenue stream evaporates overnight.

✅ What top operators do instead:

Build a direct booking ecosystem alongside OTAs: mobile-optimized site, SEO-rich pages, loyalty perks, and retargeting ads. This slashes commissions to ~4–5% effective, while securing repeat guests who book direct — future-proofing your revenue pipeline.

🚀 2. Sticking to Static Pricing

Most small operators set one price and walk away.

Meanwhile, savvy hosts use dynamic pricing tools that adjust rates multiple times daily, based on:

-

Local demand shifts

-

Competitor pricing

-

Event calendars and flight booking patterns

Why it matters:

Without it, you’re either:

-

Undercharging during high demand, leaving thousands on the table.

-

Or overpriced in slow stretches, leading to empty nights.

✅ Operators using dynamic pricing routinely see +25–40% higher annual revenue — purely from smarter rate optimization.

🤖 3. Handling Guest Communication Manually

Replying to every question, sending every welcome guide, chasing every review — it might work at 1–2 units. But by the time you hit 5 or 10, it’s the #1 growth killer (and burnout driver).

✅ What the pros do:

Deploy AI agents and automated CRM systems that:

-

Instantly answer FAQs, secure upsells like early check-in or private tours, and send check-in / checkout instructions.

-

Follow up post-stay to drive glowing reviews.

This is how top operators manage 50, 100, even 200+ listings without sacrificing guest experience — and with far fewer human hours.

🔍 4. Ignoring Reviews & Local SEO

You could own the most stunning property in the city — but if your OTA and Google profiles are weak, guests will never find you.

-

80%+ of travelers read at least 10 reviews before booking (TrustYou Revenue Impact Report, 2025).

-

Listings with higher ratings are 3.9X more likely to get booked at premium prices.

This means stacking 5-star reviews isn’t optional.

It’s how you fill your funnel at the top and justify charging 15–30% more per night.

✅ Smart operators also heavily optimize local SEO (GMB listings, location-based blogs, backlink campaigns) to pull in direct bookings outside of OTAs entirely.

🧮 5. Not Forecasting Break-Even or Occupancy

Many hosts obsess over gross bookings without ever asking:

“What’s my real break-even nightly rate or occupancy requirement to stay profitable?”

This is how seemingly busy operators — with fully booked calendars — end up cash-crunched.

Because high cleaning costs, dynamic labor, fluctuating utilities or short-notice repairs can quietly flip profit to loss.

✅ Top operators use tools like break-even analyzers and cash flow models to:

-

Adjust marketing or pricing proactively

-

Time portfolio expansions (or short-term cash buffers)

-

And confidently approve capital upgrades like adding hot tubs or luxury decor packages, knowing the payoff is covered.

🏆 The bottom line

If you want to scale like a true hospitality business — not just juggle a few listings forever — you need to:

✅ Diversify beyond Airbnb.

✅ Automate guest experience & ops at every turn.

✅ Track your unit economics like a CFO.

That’s how you build a resilient short-term rental brand that delivers predictable, compounding returns — not anxiety around next month’s calendar.

👉 Want to see exactly where you’re bleeding money or missing opportunity?

Run your numbers through our Break-Even & Dynamic Pricing Calculators, or book a free strategy call and we’ll map your ROI blueprint together.

8️⃣ Case Studies: From 2 Listings to 50+ — How Top Airbnb Investments Scale Fast

Want proof these strategies don’t just work on paper?

Here’s how serious operators — from boutique hotels to independent portfolio hosts — used smart marketing, dynamic pricing, and automation to build multi-six and seven-figure Airbnb investment brands.

🏝 LA Luxury Villa: From Boutique Rental to Booking Magnet

✅ What they did:

-

Implemented advanced Airbnb SEO to climb page one.

-

Optimized Google My Business so guests found them outside OTAs.

-

Partnered with lifestyle influencers to position the villa as the luxury stay.

✅ What happened:

-

Organic Google traffic up +78% — direct, no OTA commissions.

-

Nightly rates jumped +40%, because higher perceived brand value means guests pay more.

-

Direct inquiries surged +150%, building a real pipeline they control — slashing OTA fees and stacking repeat guests.

🏔 Aspen STR Portfolio: Filling the Calendar, Raising the Floor

✅ What they did:

-

Deployed AI-driven dynamic pricing to auto-optimize nightly rates for demand, local events, and comps.

-

Integrated advanced channel managers to eliminate double bookings and smooth last-minute guest transitions.

✅ What happened:

-

Occupancy climbed from 40% to 90%, unlocking +$125K in extra annual revenue on the same asset base.

-

ADR up +32%, capturing high-season peaks instead of underpricing.

-

Last-minute vacancies slashed -80% — fewer empty nights, almost all booked at premium rates.

🏨 The Betsy Hotel (Miami): Turning Direct into a Profit Engine

✅ What they did:

-

Launched a new direct booking website, layered with local SEO + Google Ads targeting intent-driven travelers.

-

Built automated email funnels that nurtured past guests into loyal, repeat bookers.

✅ What happened:

-

+65% more direct bookings, cutting OTA middlemen out of most repeat stays.

-

Saved $720K+ annually in OTA commissions — money now reinvested into property upgrades and high-return campaigns.

-

Repeat guests jumped +30%, driving a 7X ROAS and skyrocketing lifetime guest value.

🚀 The bottom line

These aren’t just nice wins. They’re how top hosts turn:

-

Scattered bookings into a predictable cash engine,

-

OTA dependence into direct brand equity,

-

And a couple listings into a 50+ unit portfolio that grows in value — not just occupancy.

9️⃣ Your Airbnb Investment Scaling Checklist for 2026

Want to know if you’re truly running a real Airbnb investment enterprise — or just stuck in an exhausting listing hustle that depends on Airbnb’s whims?

Use this checklist to see where your Airbnb investment strategy stands (and where the money leaks are hiding).

✅ Direct Booking Engine Live & Optimized

-

SEO-optimized website that ranks on Google for “vacation rental [city],” converts on mobile, and slashes OTA commissions to protect your Airbnb investment margins.

-

Properly built systems consistently drive +30–50% more direct bookings within 90 days, compounding lifetime guest value while strengthening your Airbnb investment brand (not Airbnb’s).

✅ Dynamic Pricing + Break-Even Targets Locked In

-

Smart pricing tools that adjust multiple times daily for seasonality, local demand spikes, competitor activity, and your unique break-even points — maximizing the returns on your Airbnb investment portfolio.

-

This means no more guessing rates — you protect cash flow in shoulder seasons and capture peak ADR when demand explodes, directly improving your Airbnb investment ROI.

✅ Retargeting Campaigns Running on Google & Meta

-

Don’t pay for traffic once and watch it bounce.

-

Precision ads bring back visitors who checked your calendar but didn’t book, delivering 2–3 extra direct bookings per week — with zero OTA cut.

✅ AI-Driven Guest Experience & Automated Review Funnels

-

24/7 AI sales & concierge agents instantly reply to booking inquiries, handle FAQs, drive upsells (like early check-ins, local tours, or private dinners), and request 5-star reviews.

-

This typically lifts conversion rates by +40%, shortens booking windows, and stacks reviews that fuel even more future bookings.

✅ Centralized Performance Dashboard

-

One place to track occupancy %, ADR, RevPAR, marketing ROI, and savings vs. internal staff costs, so you can scale confidently instead of relying on gut feel or messy spreadsheets.

⚠️ The reality:

If you’re missing even one of these, you’re leaving serious money on the table — or worse, still chained to Airbnb’s algorithm with no backup plan.

👉 Want to see exactly how much more profit you could unlock this year?

Run your numbers through our free ROI Calculator, or book a strategy call today to get a custom plan that positions your STR business to scale like a 7-figure brand.

🔟 Ready to Grow? Get Your Free Tools & Custom ROI Plan

If you’re serious about taking your Airbnb or short-term rental business to the next level, we’ve built a complete toolkit to help you scale smarter — and a clear plan to show exactly how it pays off.

Inside Your Exclusive 2026 Growth Toolkit

-

The Profit Booster Cheatsheet: Packed with 13 actionable tactics to drive more revenue without adding more listings.

-

Our 7-Figure Ads Checklist: Launch proven campaigns that bring direct bookings — not just clicks.

-

The AI Playbook: Shows you how to deploy a 24/7 growth team that handles guest inquiries, reviews, and upsells while you sleep.

-

Powerful ROI Calculators: Stress-test different scenarios and see exactly what your revenue and profit could look like.

Then we go one step further. Book a free strategy call, and we’ll map out a custom plan to scale your Airbnb business toward 7 figures — no fluff, no cookie-cutter “advice,” just clear numbers and a blueprint to maximize your cash.

👉 Claim your toolkit and strategy session today. Let’s turn your listings into a real growth machine.